Did you know that applying for annual rent receipts can save you time and hassle when it comes to tax purposes or rental reimbursement? If you’re looking to streamline this process and make it easier for yourself, read on to find out how to apply for annual rent receipts.

The Origins of Application for Monthly Rent Receipts

The Need for Documentation

Since the concept of renting properties began, there has always been a need for documentation to ensure transparency and accountability. Rent receipts serve as proof of payment and are essential for both tenants and landlords.

Transition to Annual Receipts

In the earlier days, monthly receipts were the norm, with tenants having to collect and keep track of multiple documents throughout the year. However, to simplify the process and reduce paperwork, the idea of annual rent receipts was introduced.

Current Trends and Statistics

Increasing Digitization

In today’s digital age, there is a growing trend towards the digitization of rent receipts. Many landlords now provide electronic receipts, which can be easily accessed and stored on devices or in cloud storage.

Importance in Tax Compliance

With stricter tax regulations, the demand for accurate rent receipts has increased. Many countries require tenants to provide annual rent receipts as proof of expenses for tax deductions. This trend has resulted in tenants actively seeking out rent receipts.

Practical Tips for Applying for Annual Rent Receipts

Communication with Landlord

Start by communicating with your landlord about your need for annual rent receipts. Explain the purpose and ensure they are willing to provide them. It’s important to establish this understanding from the beginning.

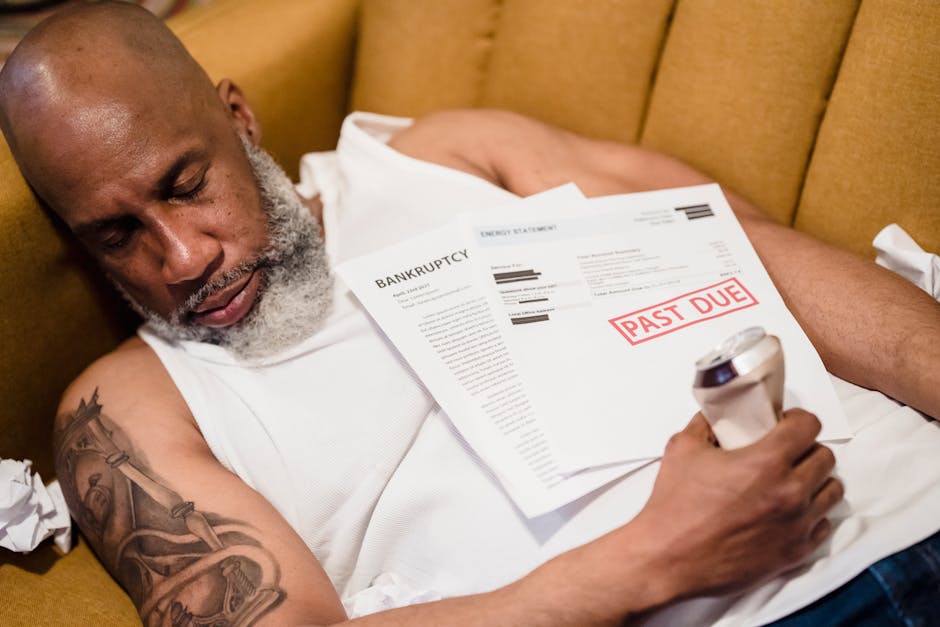

Organization and Record-Keeping

Keep track of your monthly rent payments throughout the year. This will make it easier to compile the necessary information when applying for annual rent receipts. Consider using digital tools or apps to help with organization.

Follow Proper Timelines

Be aware of the deadlines and timelines set by your landlord for requesting annual rent receipts. Ensure you submit your application within the specified timeframe to avoid any delays or complications.

The Future of Application for Monthly Rent Receipts

Integration with Digital Platforms

In the future, we can expect to see more integration between rental platforms and digital receipt generation. This automation will streamline the process, making it even more convenient for both tenants and landlords.

Blockchain Technology for Transparency

Blockchain technology has the potential to enhance the transparency and security of rent receipts. By leveraging blockchain, all parties involved can have access to a tamper-proof record of rent payments, eliminating any disputes or discrepancies.

Applying for annual rent receipts doesn’t have to be a tedious task. By understanding the background, staying updated with current trends, following practical tips, and looking towards future advancements, you can simplify the process and save yourself time and hassle.

Final Thoughts on Application for monthly rent receipts every year

Applying for monthly rent receipts every year is an important step in staying organized as a tenant. By keeping a record of your rental payments, you have solid proof of your financial responsibilities and can easily dispute any discrepancies that may arise. Moreover, having these receipts can come in handy when applying for a loan, filing taxes, or settling any rental disputes. Take the time to understand your rights as a tenant and the requirements set out by your landlord to ensure you receive all the necessary documentation.

Further Reading and Resources

1. How to Use an Online Rent Payment (and When You Shouldn’t)

This article discusses the benefits and drawbacks of using online rent payment platforms. It provides valuable insights into when it’s appropriate to use such platforms and when you should stick to traditional methods.

2. Publication 527 (2020), Residential Rental Property

The Internal Revenue Service (IRS) provides this publication that outlines the rules and regulations surrounding residential rental properties. It includes information on deductions, reporting rental income, and tax obligations for both landlords and tenants.

3. The Difference Between an Annual Lease & Rent

If you’re unsure about the differences between an annual lease and month-to-month rent, this resource will shed some light. It explains the pros and cons of each rental agreement and helps you make an informed decision based on your circumstances.

4. Tenant’s Right to Break a Rental Lease in Oregon

This resource focuses on the rights and procedures for tenants in Oregon who need to break their rental lease. While specific to Oregon, it provides insights into the rights and responsibilities of tenants in similar situations in other jurisdictions.

5. How to Handle Landlord-Tenant Disputes in a Small Claims Court

If you find yourself in a landlord-tenant dispute that cannot be resolved through communication, this resource offers guidance on navigating the small claims court process. It outlines the steps to file a complaint and provides tips on presenting your case effectively.

Whether you’re a new or experienced tenant, having a system in place for requesting and organizing monthly rent receipts is crucial. Stay informed about your rental rights, and make sure you have the necessary documentation to protect yourself and your financial interests.

답글 남기기